Clinton Foundation Promises, And Tax Returns, Don't Add Up

- brendawebber

- Apr 24, 2015

- 2 min read

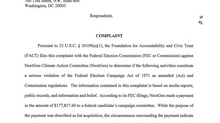

The Clinton Foundation, the nonprofit empire built by Bill and Hillary Clinton, has come under scrutiny for accepting donations from foreign governments, corporations, and individuals during Hillary Clinton’s time as Secretary of State. The blatantly obvious conflicts of interest that existed then continue today after Clinton announced her presidential candidacy. The Clinton Foundation could become a vehicle for donors to curry favor with the Clinton family generally, and Hillary Clinton specifically.

The way to address these potential conflicts of interest is more disclosure and accountability, not less. However, the Clinton Foundation has done the opposite, promising reform but leaving open glaring loopholes to allow foreign money to continue to pour into an organization directly tied to a major presidential candidate. This shouldn’t be a surprise since the foundation didn’t even disclose all of its foreign government donations to the IRS.

In April 2015, in response to the criticism over foreign donations, the foundation announced it would limit such donations to only six countries. The foundation’s new rules allow the organization to continue accepting donations from Australia, Canada, Germany, the Netherlands, Norway, and the United Kingdom. But on this point, the Clinton Foundation still left itself a loophole to allow ministers from any foreign government to attend foundation meetings, appear on panels, which comes with event fees of up to $20,000. This policy also did not prohibit foreign individuals or companies from donating to the Clinton Foundation.

The door for foreign donations remains wide-open at an affiliate of the Clinton Foundation, the Clinton Health Access Initiative (CHAI), which is the largest component of the Clinton non-profit universe. Theoretically, any foreign government could give millions to CHAI with no restrictions.

In July 2015, the Clinton Foundation and CHAI will begin disclosing donors quarterly, rather than once a year as they had been doing. However, the foundation continue its practice of not disclosing how much each donor gave or when each donation was given.

This failure to provide real transparency appears to be standard procedure at the Clinton Foundation since the foundation didn’t even tell the IRS about all of the donations it accepted from foreign governments. The Clinton Foundation is now amending tax returns filed with the IRS to finally disclose the foreign government money the organization received.

Maintaining trust in civic institutions requires transparency and accountability, something sorely lacking at the Clinton Foundation.

Comments